Enhancing Digital Loan Servicing for Dollar Bank

Dollar Bank enhanced its digital loan servicing to improve user experience and efficiency. The project addressed high call volumes, limited payment options, and transparency issues in the loan management process.

Problem Statement

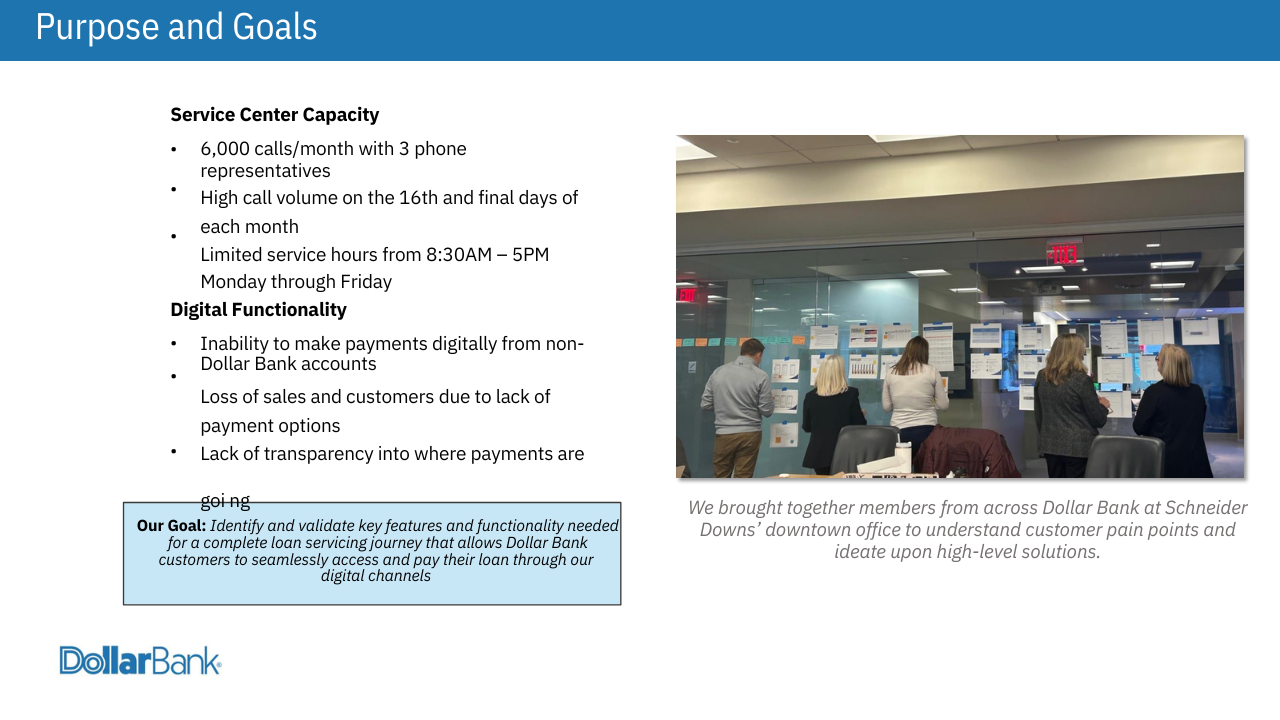

Dollar Bank faced significant challenges in its loan servicing process, particularly with digital functionality and user experience:

- Service Center Overload: With only three phone representatives handling 6,000 monthly calls, high call volumes caused delays, especially during peak times (16th and final days of each month).

- Limited Payment Options: Customers were unable to make digital payments from non-Dollar Bank accounts, leading to customer attrition and loss of sales.

- Lack of Transparency: Customers found it difficult to track where their payments went (principal vs. interest), creating frustration and trust issues.

- Usability Pain Points:

- Static statements only accessible via mail.

- Poor customer service UX.

- Lack of mobile-friendly features for loan management.

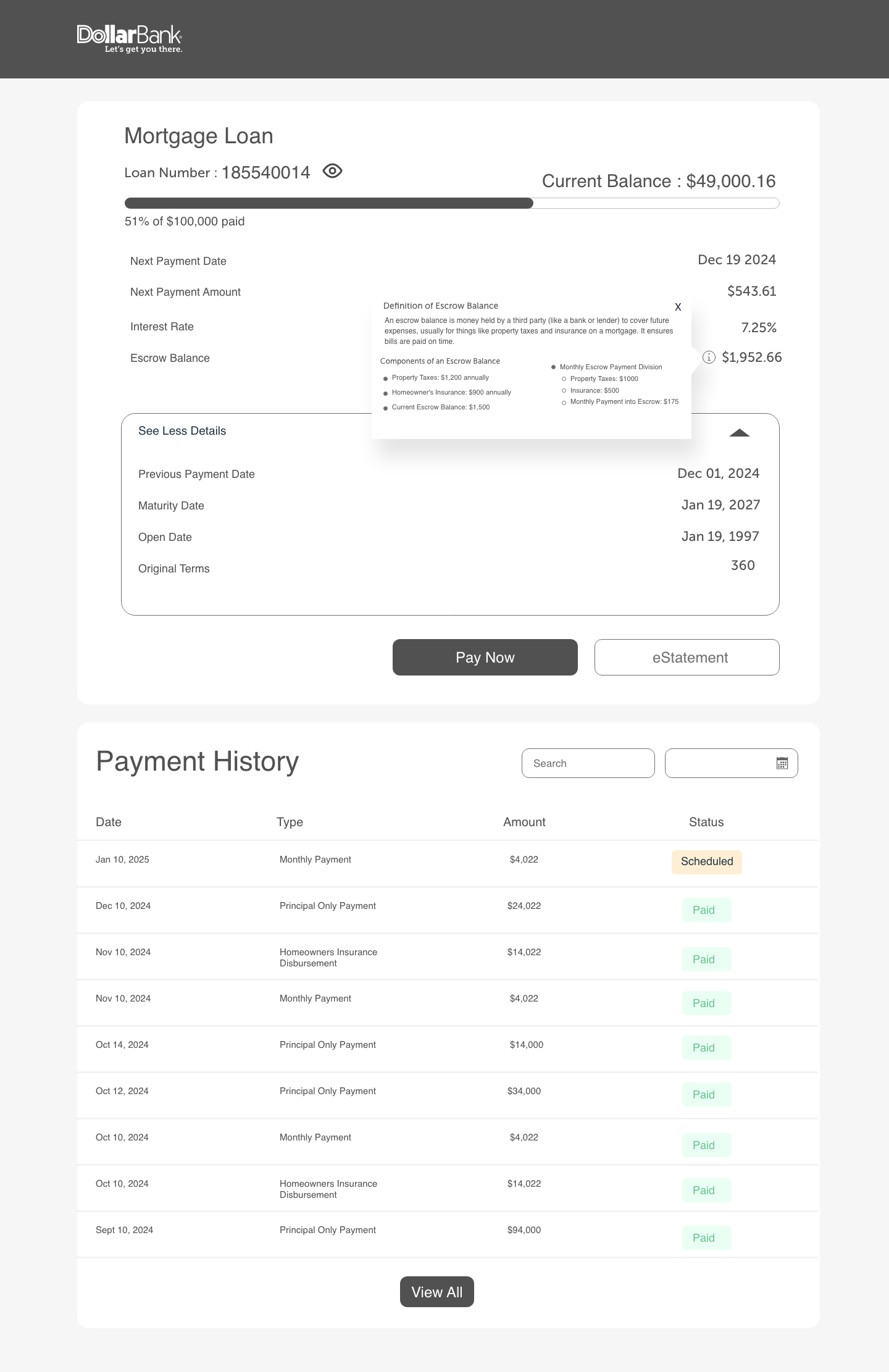

- Limited online visibility into loan and escrow details.

Solution Overview

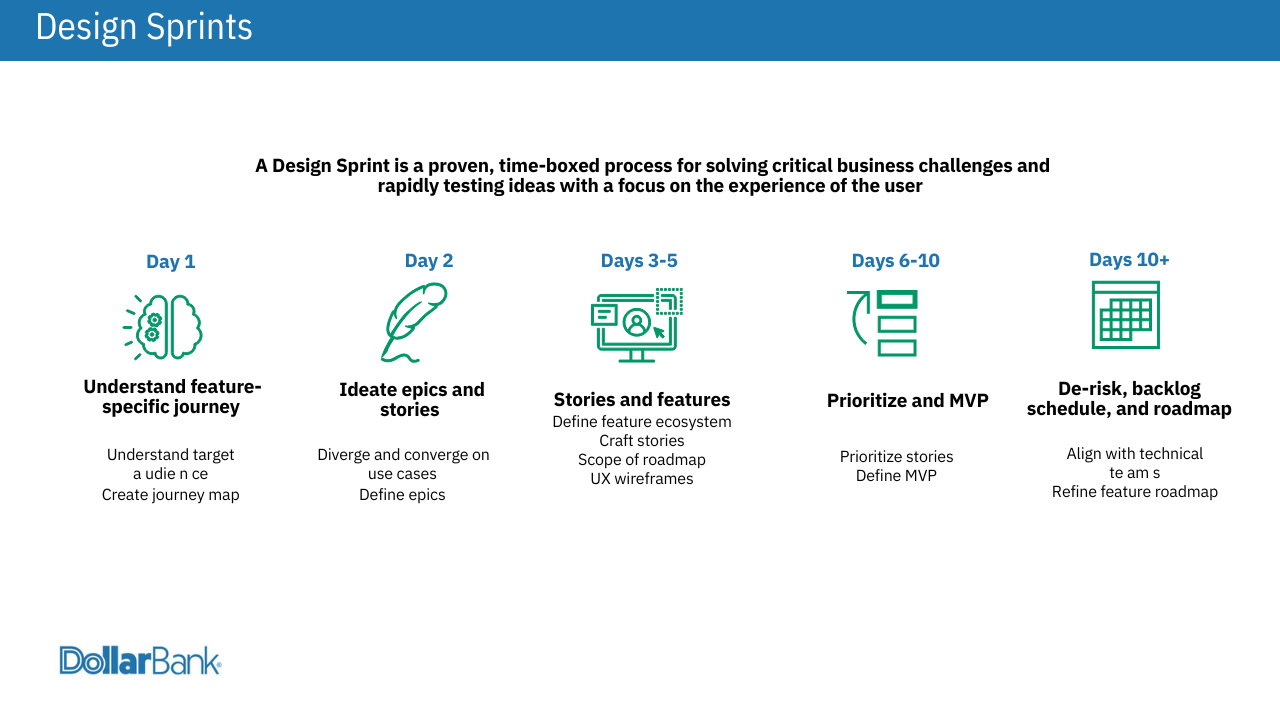

A Design Sprint was conducted to identify and address these issues through a human-centered design approach:

Discovery and Research

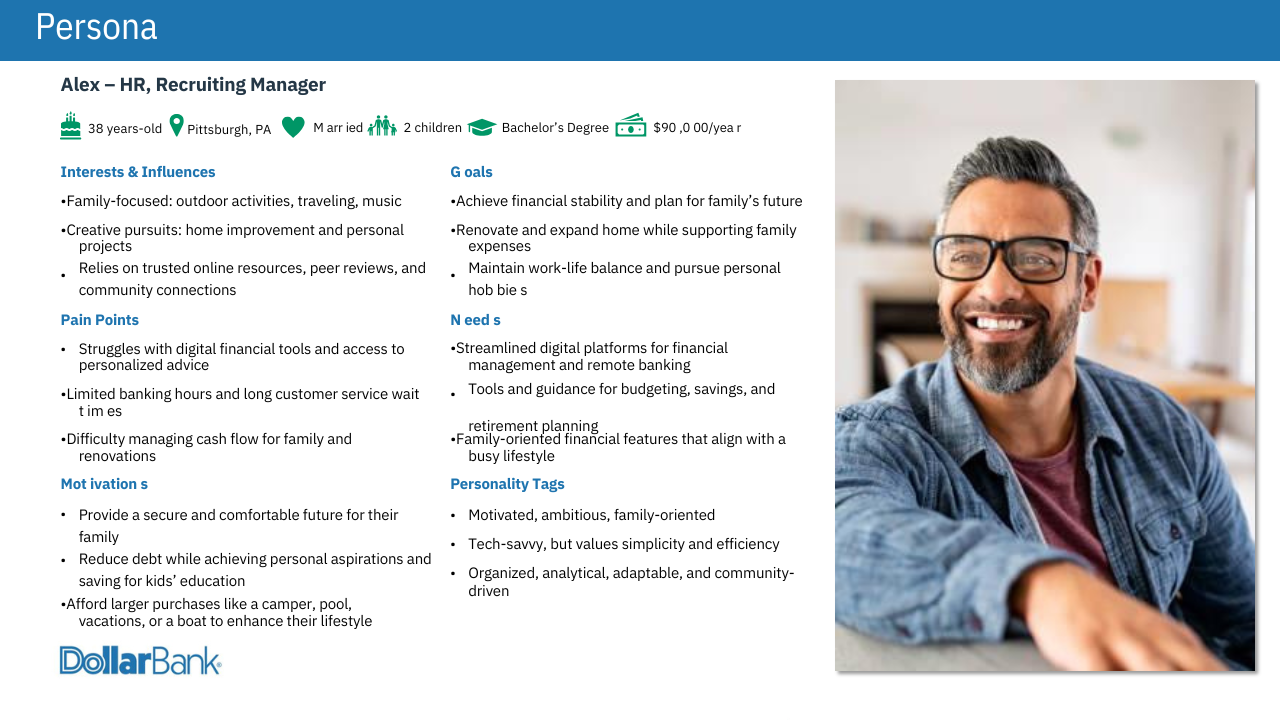

- Persona Development: Created personas like Alex, a family-oriented HR manager struggling with digital banking tools, to understand user pain points and motivations.

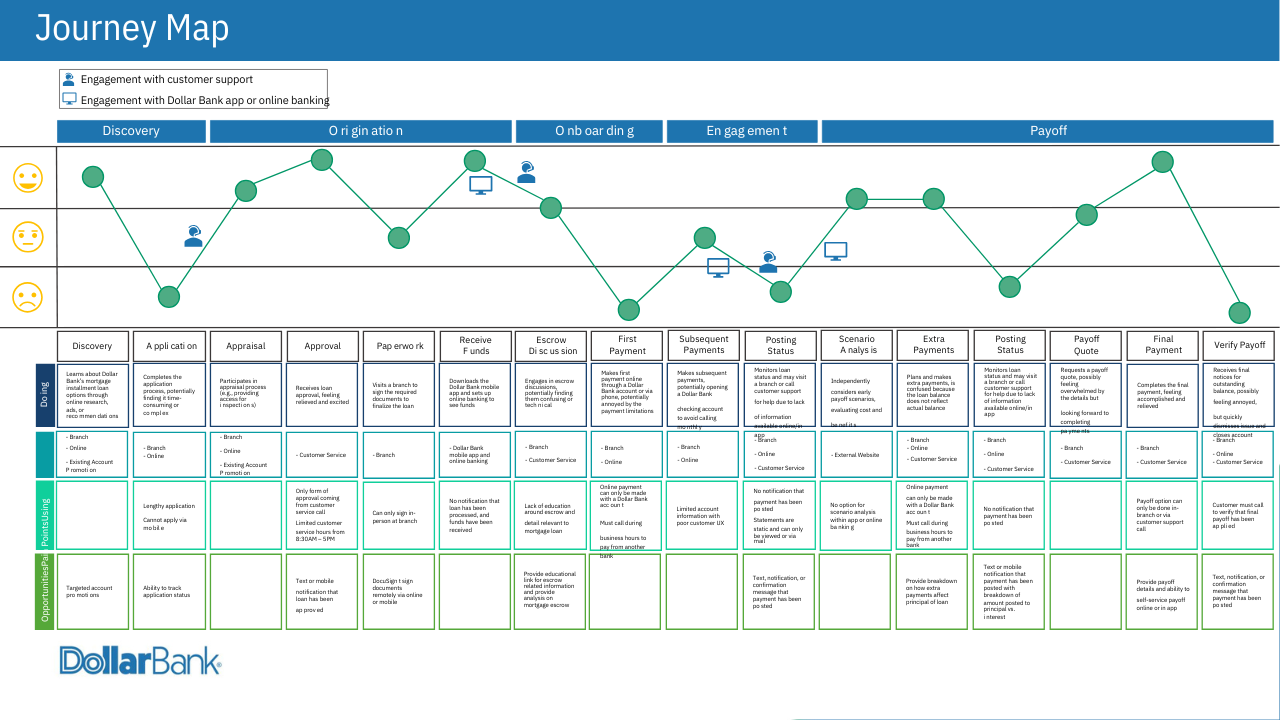

- Journey Mapping: Traced customer interactions from loan discovery to payoff, identifying specific friction points such as lengthy applications, limited notifications, and lack of payment flexibility.

Ideation and Prototyping

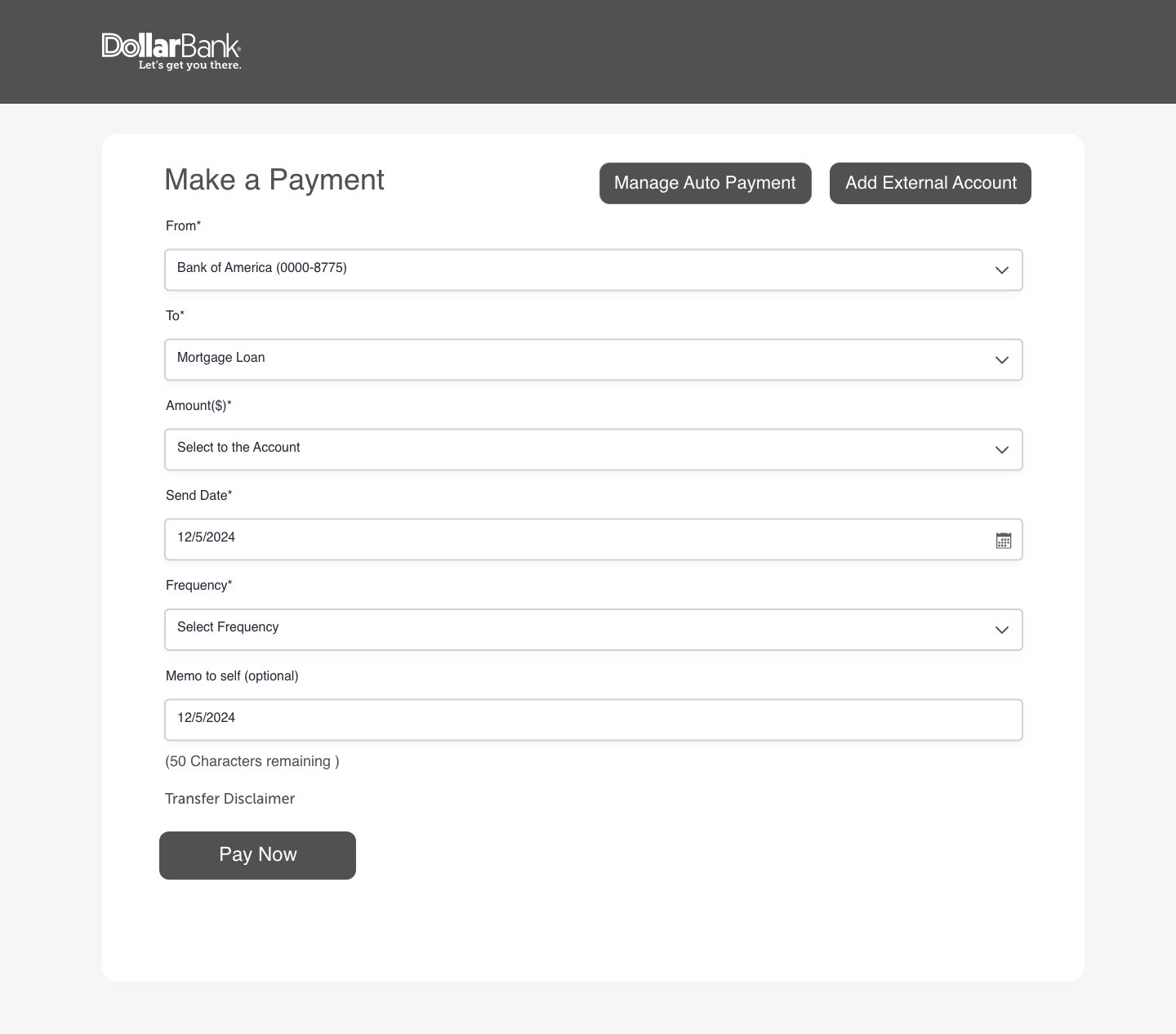

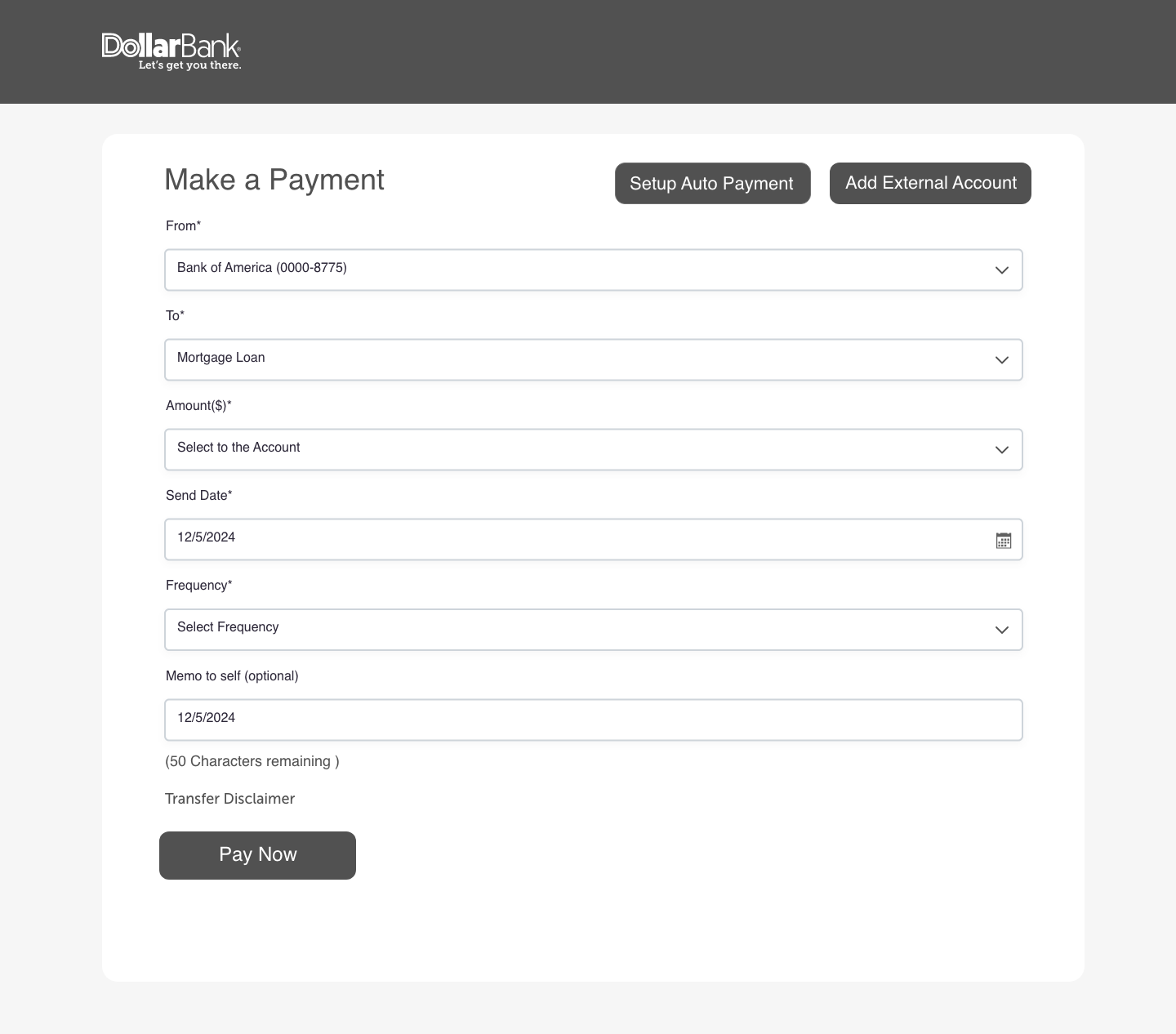

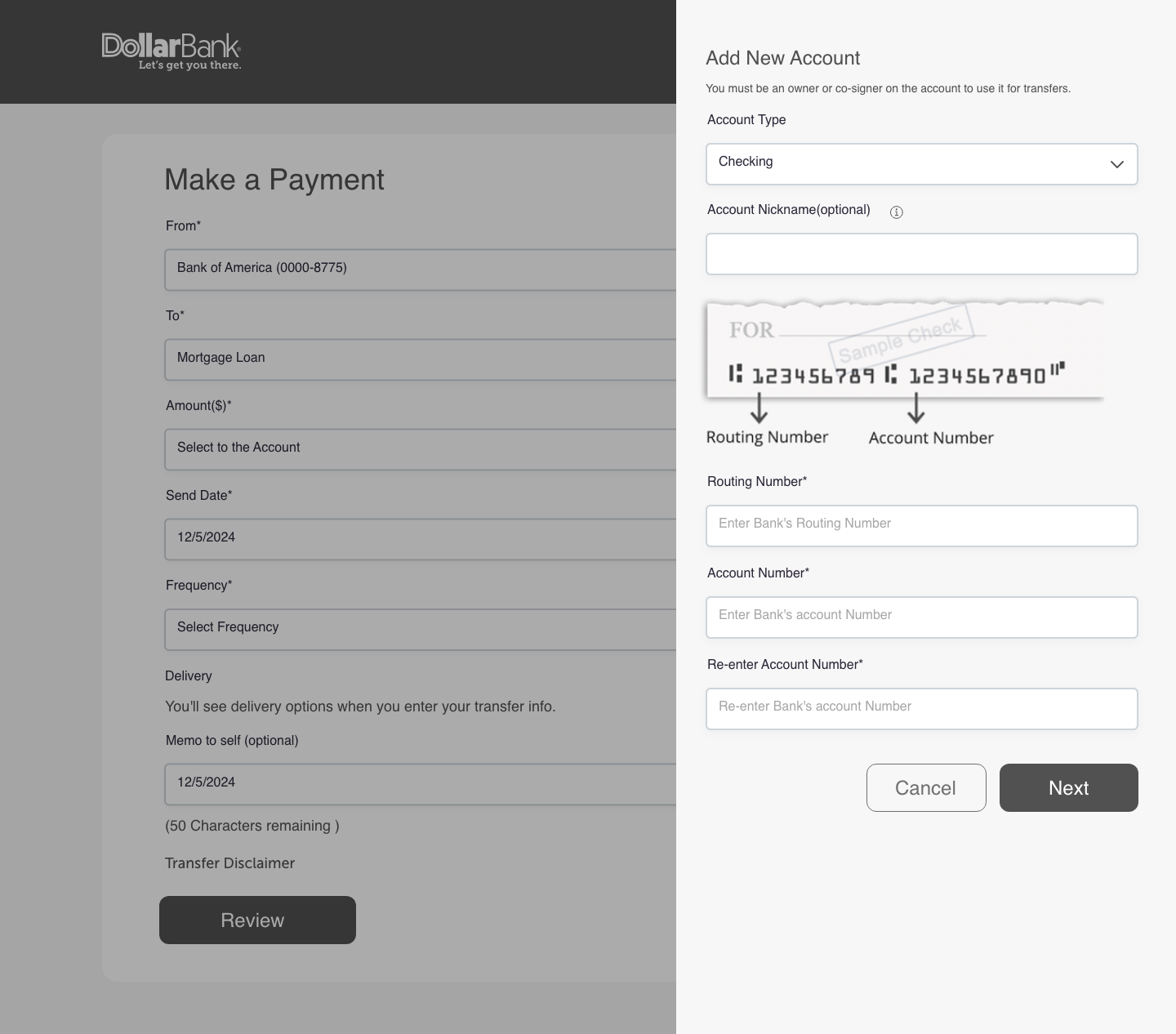

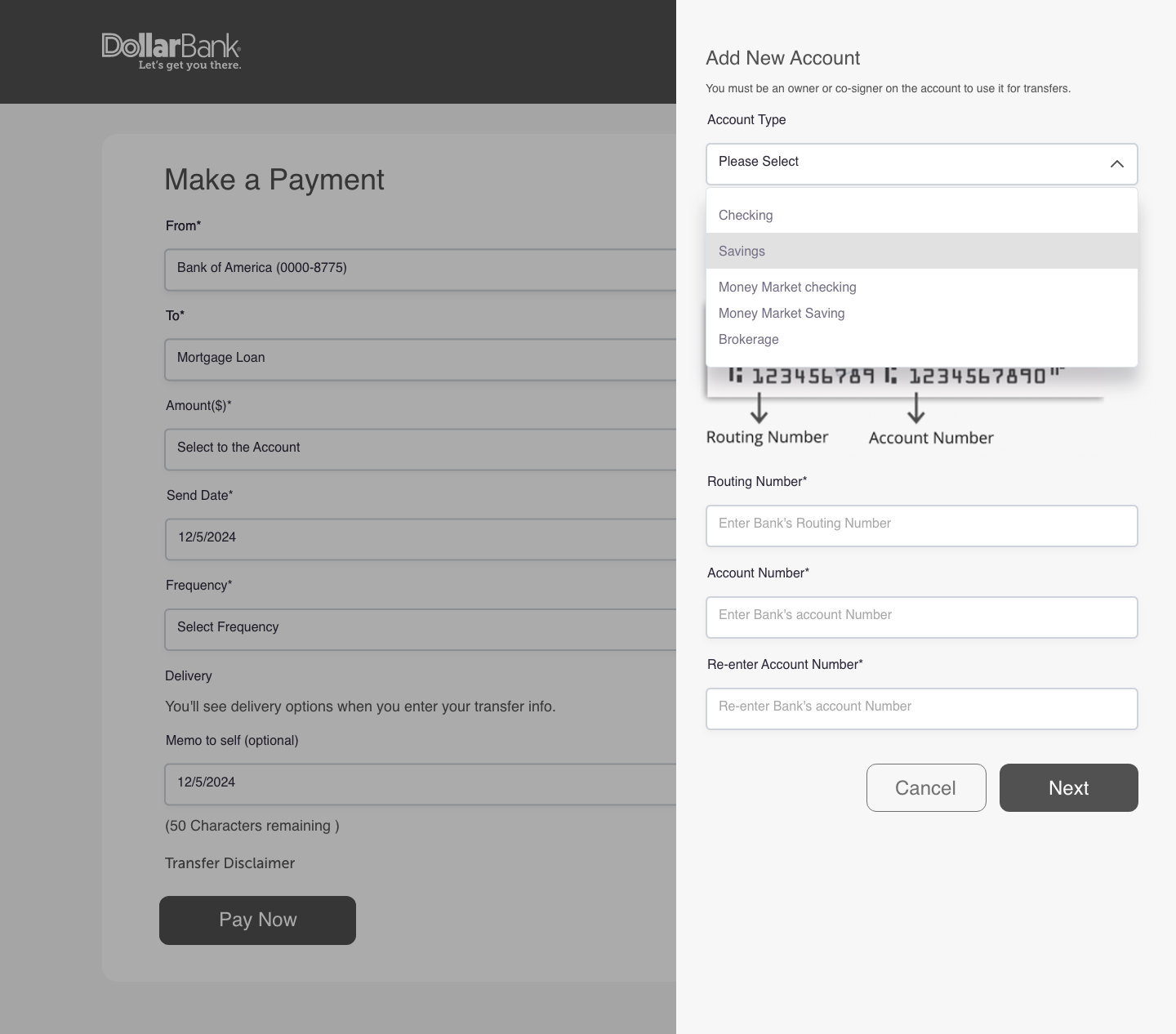

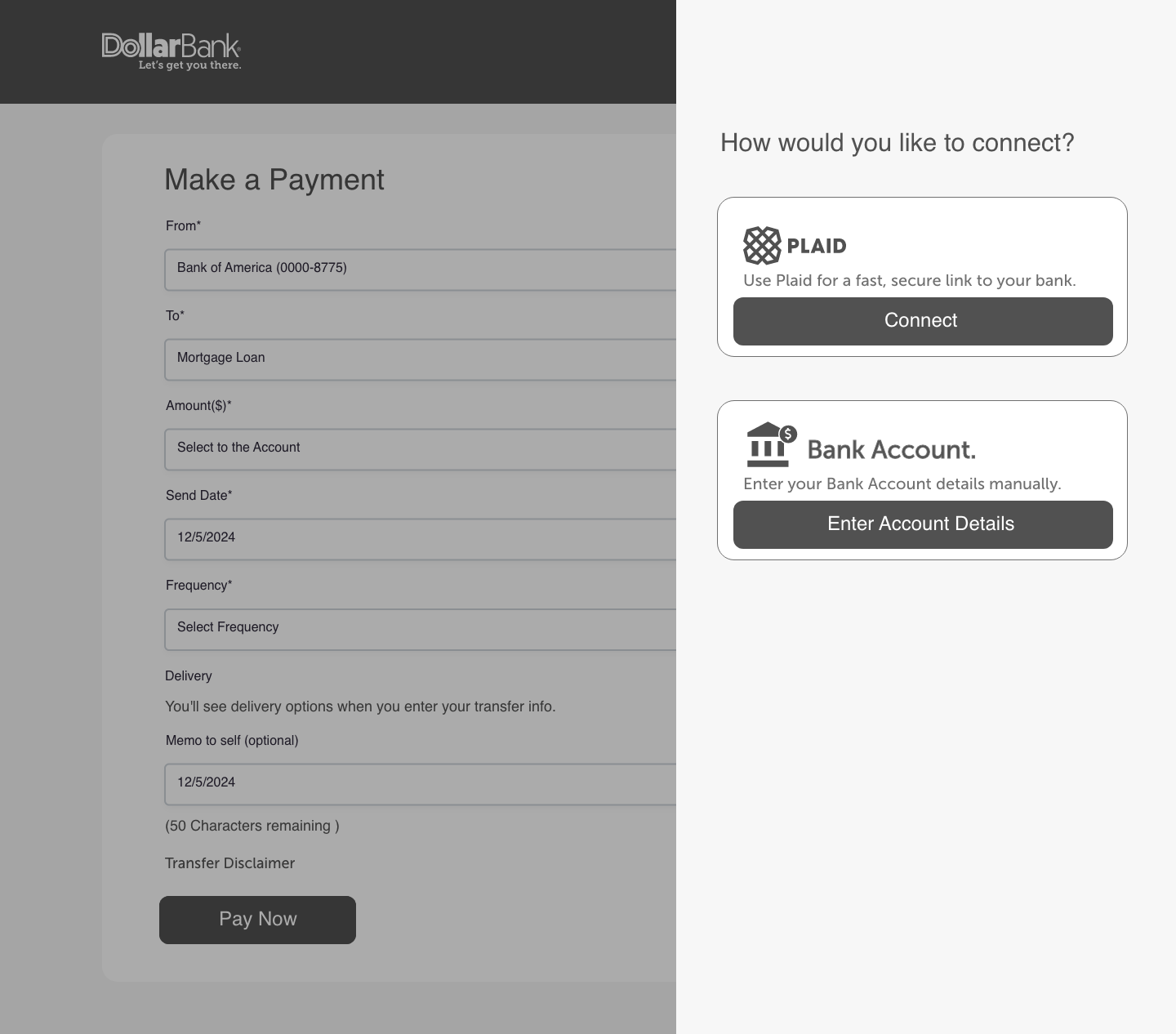

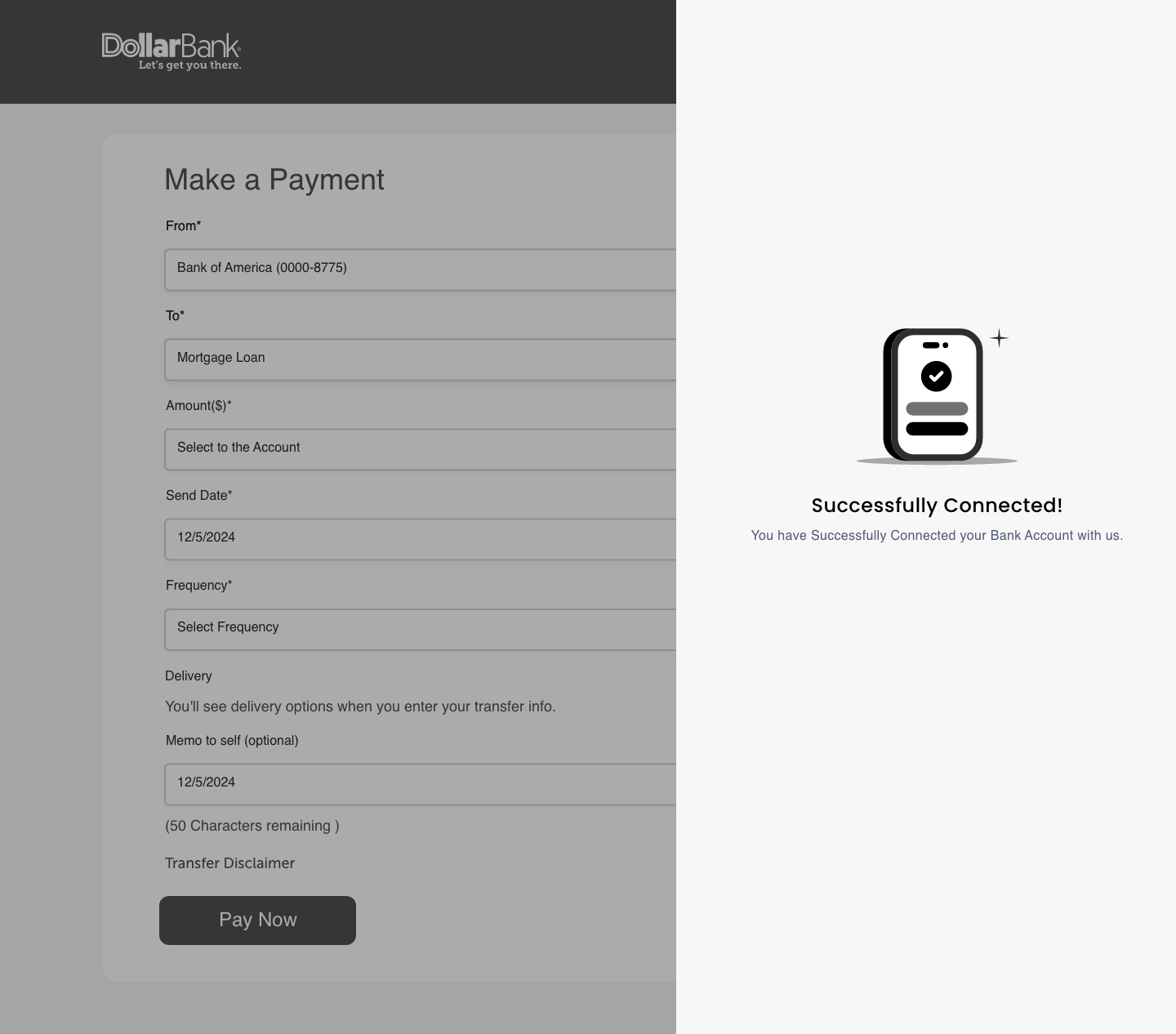

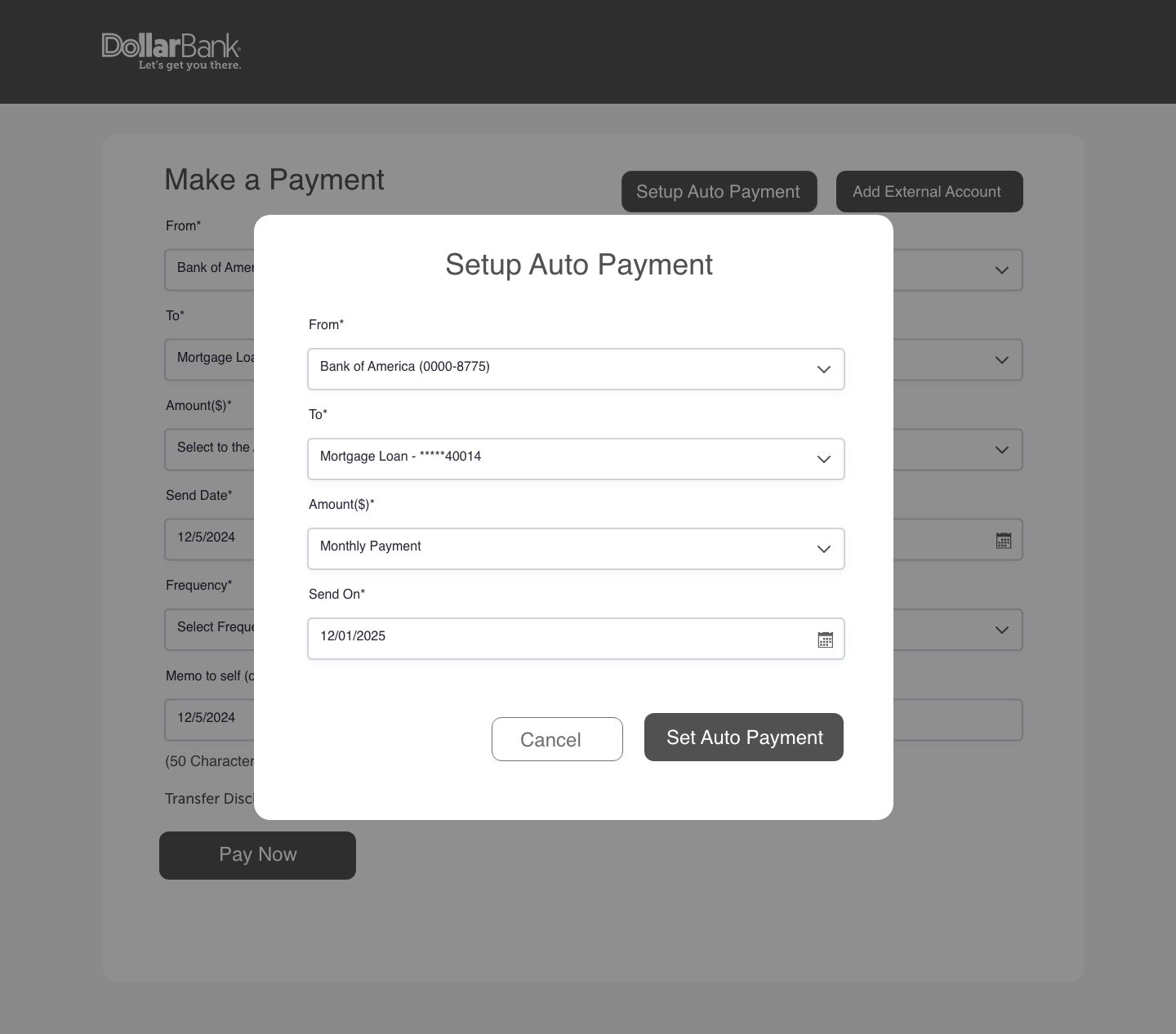

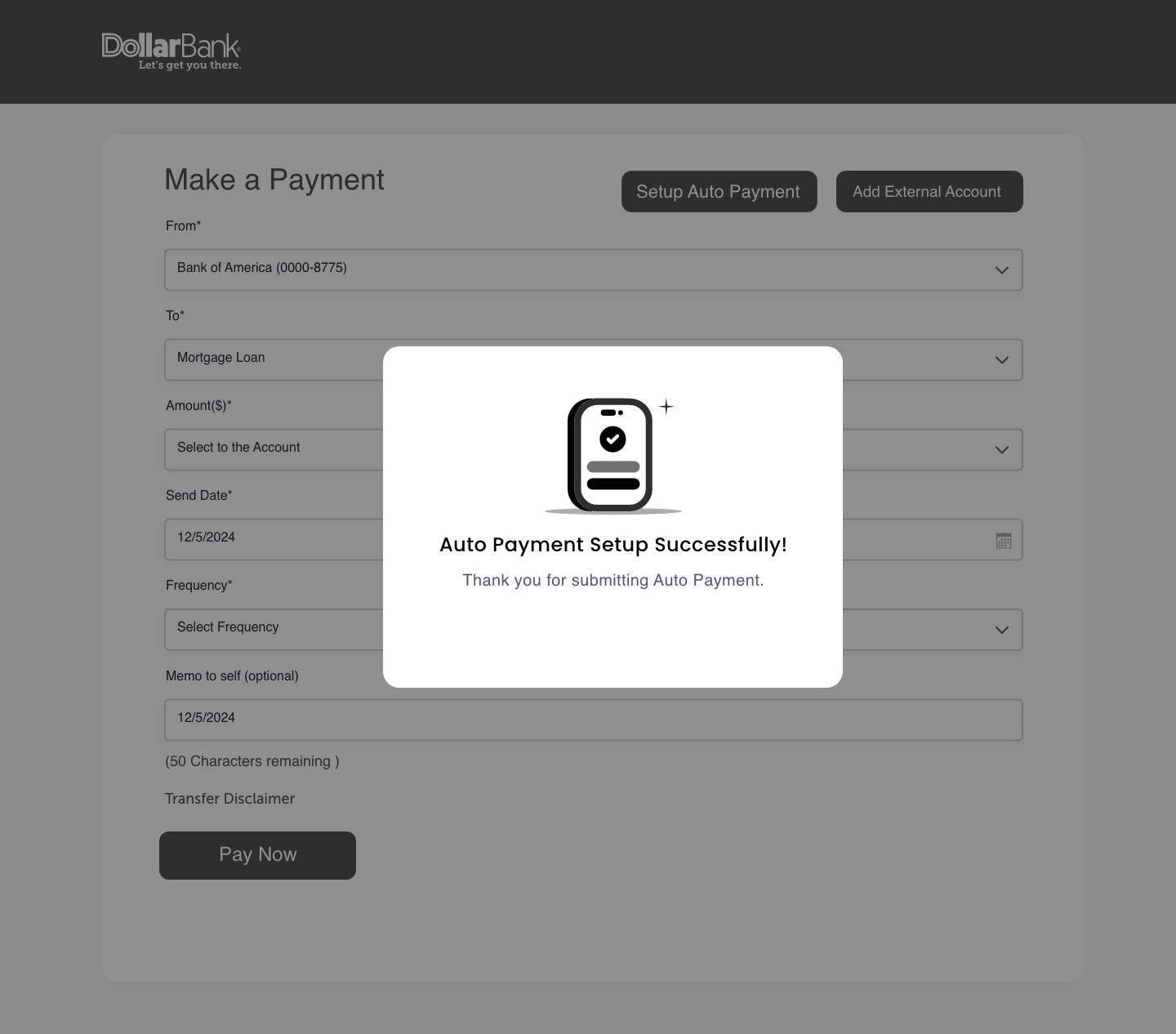

- Epics and User Stories: Developed features like viewing account summaries, making payments from external accounts, and setting up autopay.

- Prioritized MVP Features:

- Mobile-first approach for loan management.

- Online payment functionality for non-Dollar Bank accounts.

- Transparent breakdowns of payment applications.

- Notifications for loan status updates.

Testing and Insights

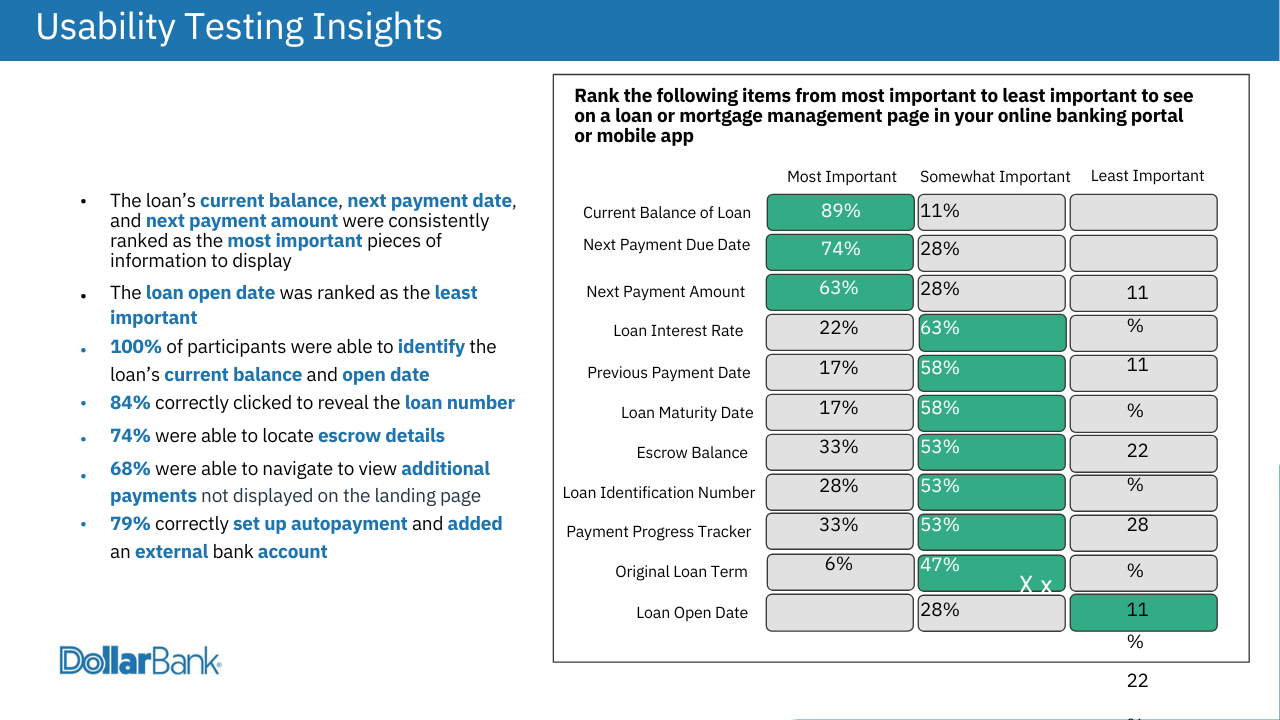

- Usability Testing:

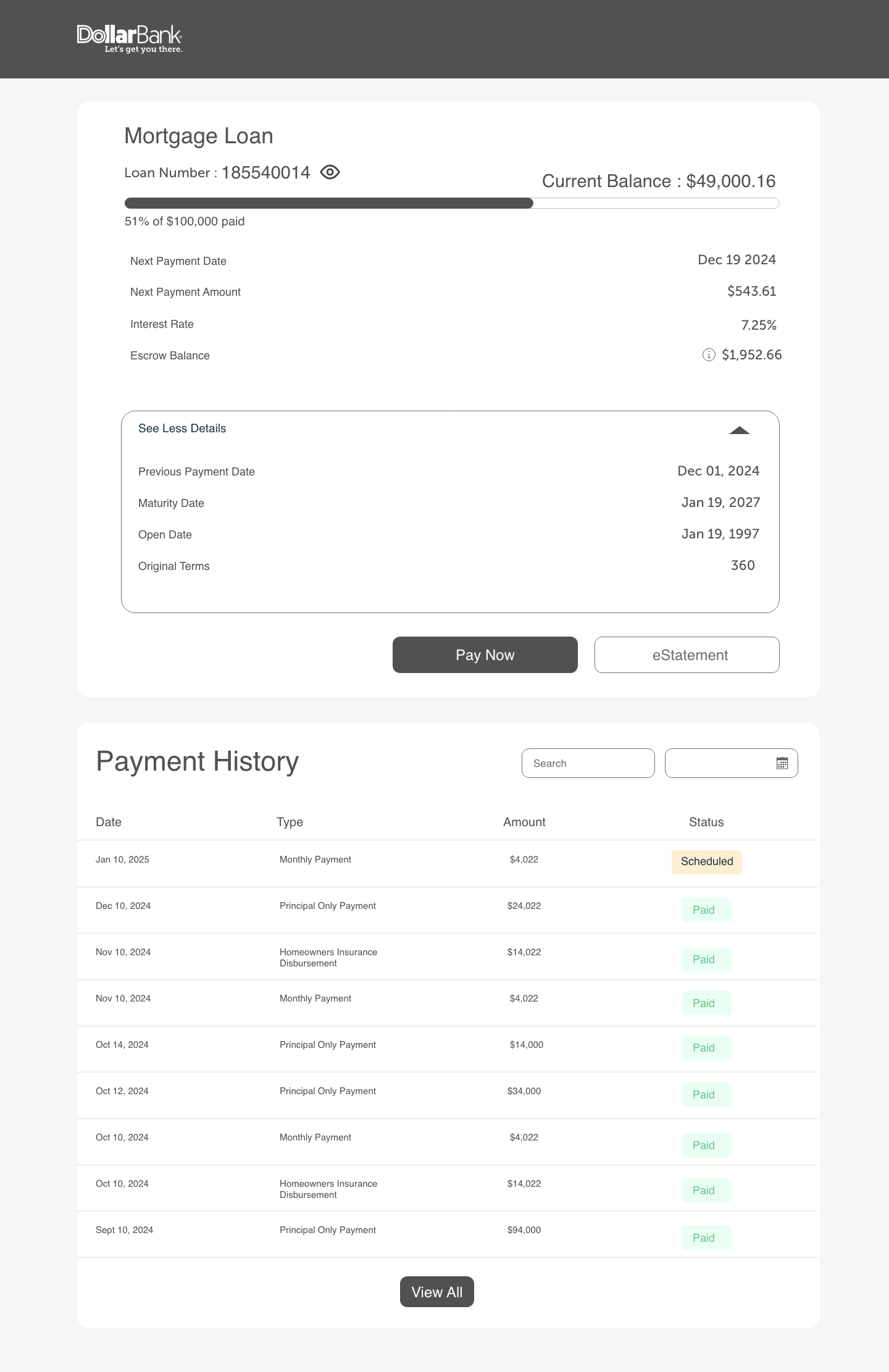

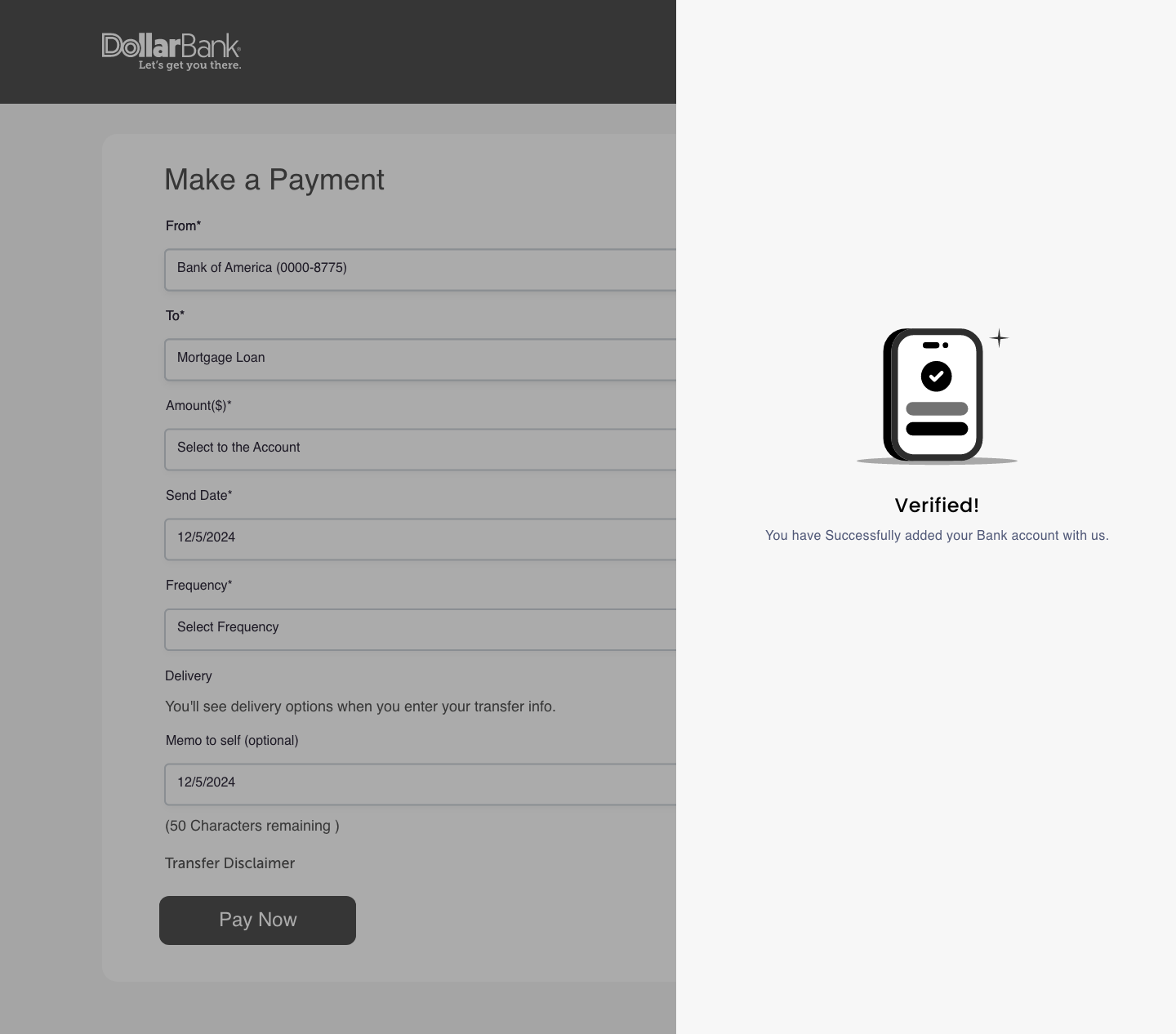

- 79% of participants successfully added external accounts and set up autopay.

- 84% located loan numbers accurately.

- The loan’s current balance, next payment amount, and due date were identified as the most critical information.

Key Outcomes

- Improved digital functionality for seamless payments from non-Dollar Bank accounts.

- Enhanced loan management transparency, with breakdowns of principal versus interest.

- Increased customer satisfaction through mobile-first designs and streamlined UX.