Dollar Bank Account Summary Redesign

The goal was to create a clean, personalized interface that simplifies everyday banking tasks, offers dynamic financial insights, and ensures a seamless mobile experience. By focusing on user-centric design, the redesigned page empowers customers to quickly understand their finances and engage with additional banking services.

Problem Statement

The existing Account Summary Page presented several challenges:

- Cluttered Interface: An overload of information made it difficult for users to quickly locate the details they needed.

- Lack of Personalization: The page felt generic, failing to reflect users’ individual banking priorities.

- Poor Mobile Experience: The design was not optimized for mobile, frustrating users who bank on the go.

- Low Engagement with Services: Customers were either unaware of or disengaged from additional banking services like credit score monitoring, CD renewals, and personalized financial insights.

Process

1. Research and Discovery

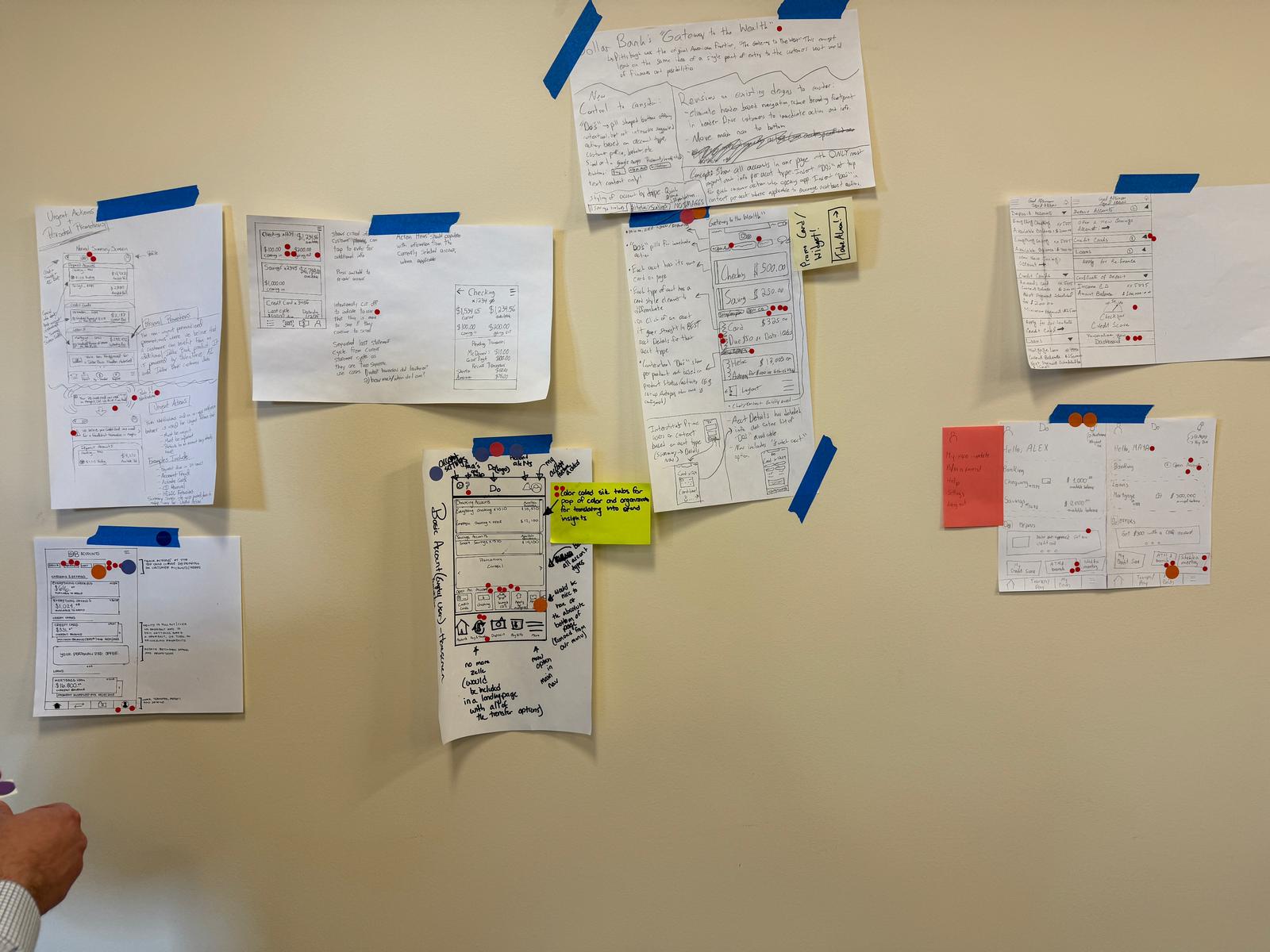

- Stakeholder Workshops: Collaborated with Dollar Bank leadership and product teams to align on business goals, technical constraints, and user needs.

- Customer Interviews: Conducted in-depth interviews with 20+ customers to uncover pain points, behaviors, and expectations.

-

User Personas: Developed three primary personas:

- The Busy Professional: Needs quick access to balances and transactions.

- The Savvy Saver: Focuses on tracking savings goals and exploring investments.

- The Mobile-First User: Prioritizes seamless mobile banking.

- Journey Mapping & Empathy Mapping: Mapped customer journeys to identify friction points and understand user emotions, motivations, and frustrations.

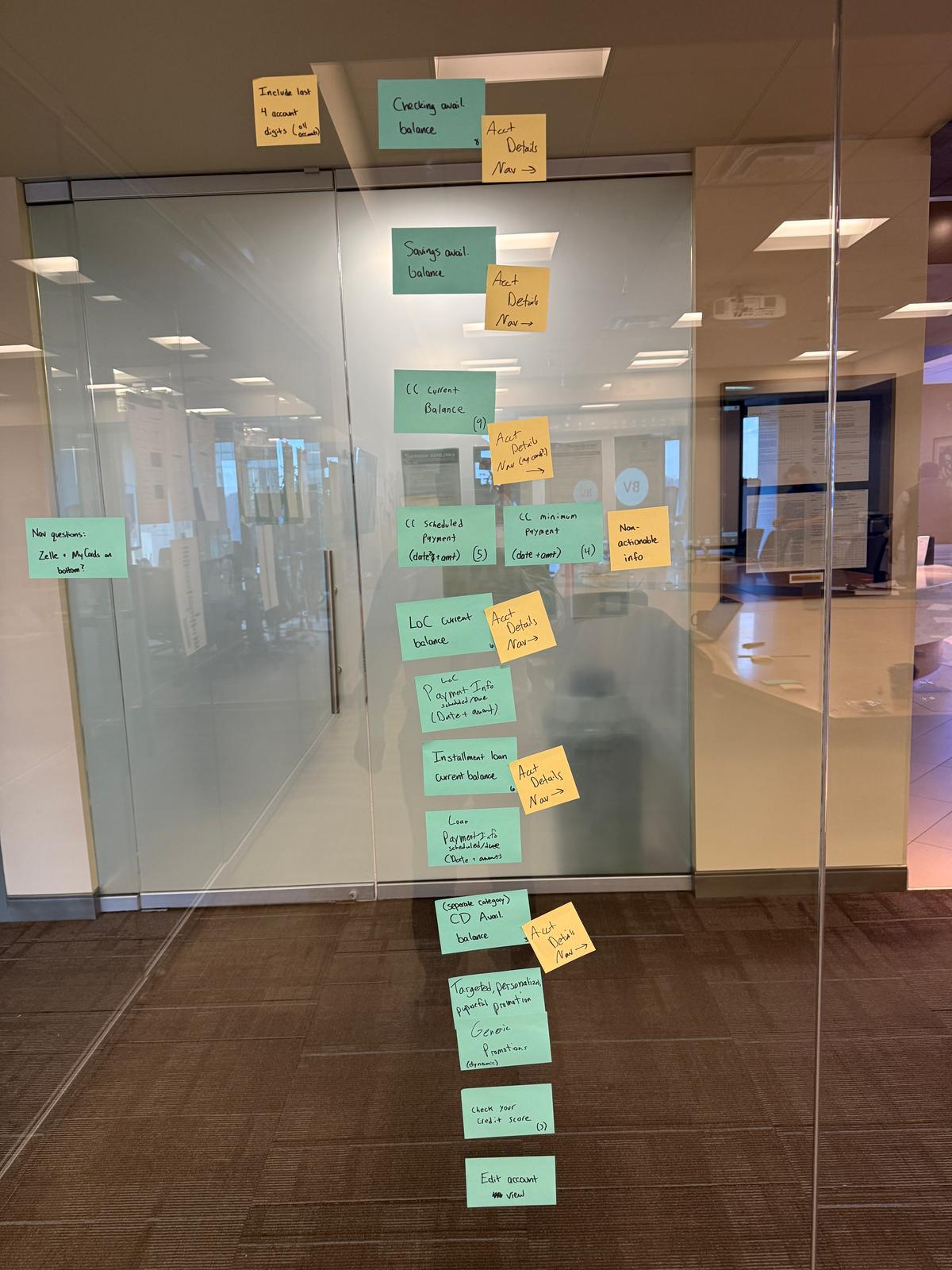

2. Ideation and Sketching

- Crazy 8s Exercise: Held rapid sketching sessions with stakeholders to generate innovative ideas for layout and features.

- Prioritization: Selected the most promising ideas with an emphasis on simplicity, personalization, and mobile responsiveness.

3. Design and Prototyping

- Wireframes: Developed low-fidelity wireframes outlining a clean, organized structure for the new page.

-

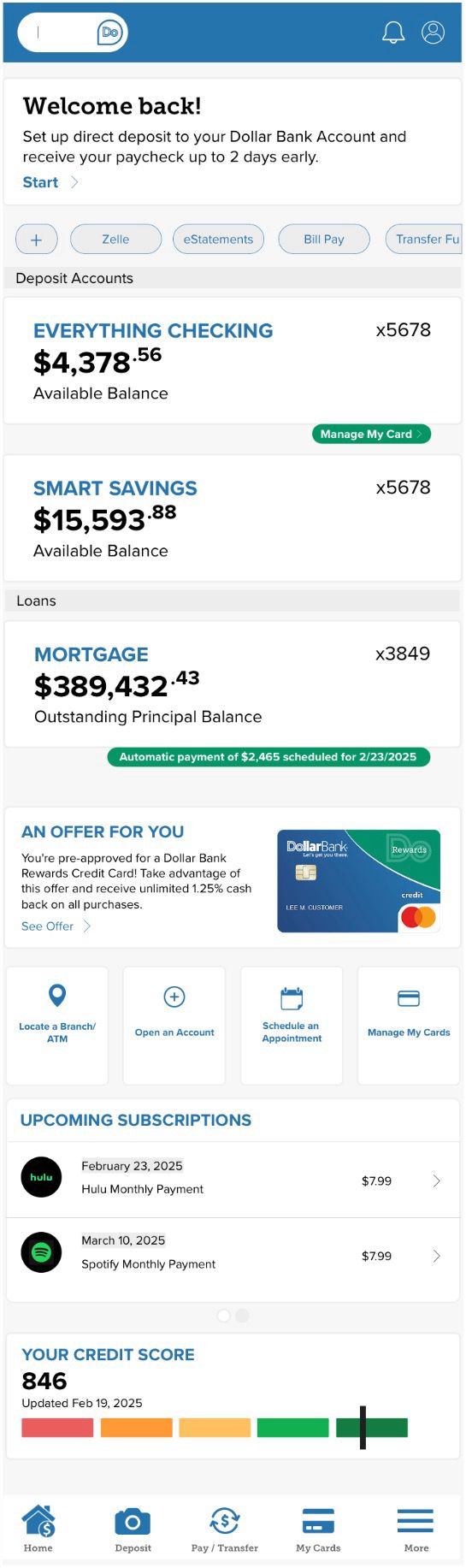

High-Fidelity Prototype: Created a detailed Figma prototype, incorporating stakeholder and user feedback. Key design elements included:

- Account Overview: A prioritized view of various account types with quick access to details.

- Personalized Insights: Dynamic content displaying spending trends, credit updates, and tailored savings goals.

- Promotional Banners: Strategically placed banners to highlight services like CD renewals and financial planning tools.

- Responsive Design: Ensured a fully optimized mobile experience with a collapsible menu and touch-friendly interactions.

4. Testing and Iteration

- Usability Testing: Conducted sessions with 10+ customers to gather actionable feedback on the prototype.

- Iterative Refinements: Adjusted elements such as font size, button placement, and navigation flow based on user insights.

Key Features of the Redesign

- Simplified Layout: Reduced clutter by grouping related information and incorporating collapsible sections for less frequently accessed details.

- Personalized Content: Delivered dynamic insights tailored to individual user behaviors, including spending trends and financial tips.

- Mobile-First Design: Prioritized a responsive, intuitive mobile experience with larger touch targets and streamlined navigation.

- Service Promotions: Integrated subtle promotional elements to drive engagement with additional banking services.

Results

- Improved Usability: Post-launch surveys revealed a 35% increase in user satisfaction, with customers praising the streamlined and easy-to-navigate design.

- Higher Engagement: A 25% increase in click-through rates on promotional banners drove more users to explore additional services.

- Mobile Adoption: Mobile banking usage rose by 20% within the first three months following the redesign.

- Stakeholder Approval: Dollar Bank’s leadership commended the project for its user-centered approach and alignment with business goals.

Conclusion

The redesign of Dollar Bank’s Account Summary Page effectively addressed key user pain points, delivering a clean, personalized, and mobile-friendly experience. By leveraging a design sprint methodology that integrated stakeholder collaboration, extensive user research, and iterative design practices, the project not only enhanced usability but also drove higher engagement with essential banking services.